Resources / Insights

How OEMs Can Lead the Circular Economy Revolution

OEMs are uniquely positioned to lead the transition to a circular economy in electronics.

According to the UN E-waste Monitor, e-waste is the fastest growing waste stream in the world. While original equipment manufacturers (OEMs) around the world are taking greater steps to recycle their electronic products, more needs to be done. The circular economy – an economy based on refurbishing, reusing, repairing and recycling products – is key to the battle against waste.

A boom in global demand for consumer electronics means that rates of e-waste production has risen five times faster than recycling rates since 2010. E-waste is a challenging and ever evolving waste stream, with new products requiring new, specific treatment. Recycling needs a transformation, not just for end-of-life items, but from the manufacturing stage.

Manufacturers can show leadership – moving ahead of regulations rather than in-step with them. Some companies like Apple, Samsung, Microsoft and Dell made early moves to recycle their old items, taking them back at an off-set cost against new purchases. 88% of consumers are more likely to be loyal to a company with good sustainability policies. Perception is key to brand development – it’s important to not only be sustainable, but also to be recognised as being sustainable. Customers and audiences need to know what you’re concretely doing to achieve your environmental, social and government (ESG) goals.

ESG and branding benefits of the circular economy

ESG stands for ‘environmental, social and governance’ and encompasses the guiding principles and specific activities adopted by an organisation to make a positive impact – on the natural world, on how it treats people, and how it is directed and controlled. All supported by data-driven, measurable, and reported goals and standards. Adopting circular economy practices is an important part of this ESG approach.

Commitment to ESG is also a demonstrated benefit for brands. McKinsey and NielsenIQ found in a joint study that “Products making ESG-related claims averaged 28% cumulative growth… versus 20% for products that made no such claims.”

Celebrating achievements like reductions in waste, initiatives to lower carbon emissions, and championing sustainability partnerships with accredited organisations (like The Royal Mint) will show that a brand is serious about its ESG commitments. The transparency of ESG frameworks makes it easy for consumers to see what actions a brand is taking. Consumers are saturated with sustainability messaging and green claims, and they increasingly see through it. Greenwashing – companies deceiving the public by promoting false solutions to the environmental crisis – can more harmful to a brand than no action at all.

In a competitive marketplace, with increasingly savvy consumers, a solid environmental track record can be the difference between growth or stagnation. By setting concrete ESG goals, putting in place the policies to achieve them, and then publicising those achievements, brands can build a strong marketing platform for building trust, giving them an edge over its competitors.

OEMs, regulations, and proactive engagement

Extended producer responsibility (EPR) policies at national and international levels are seeking to pass recycling responsibilities onto manufacturers rather than governments or the public. But waste management is not enough, and both manufacturers and society more broadly must reduce the amount of waste we are generating in the first place.

Some steps are being made at a regulatory level to formalise the circular economy, such as the EU’s landmark ‘right to repair’ directive. This aims to make repair a cheaper and more achievable option for consumers than replacement, cutting a huge amount of waste from disposing of still usable products. An recent study has found that almost two-thirds of customers would rather repair an item than replace it.

France has been leading a push against ‘premature’ obsolescence in tech products (planned obsolescence is already a prosecutable offence), creating a national repairability index to score products based on their ease of repair. This comes alongside a durability index that highlights the companies taking a proactive stand for the longevity of their products. There are already plans for a similar Europe-wide index. This initiative seeks not only to name and shame producers generating unnecessary amounts of e-waste, but also to celebrate positive role models.

It is highly likely that such programmes will become more commonplace across developed economies, where the public are already reckoning with their consumption habits and environmental impact. The right to repair is forcing electronics producers to implement better recycling pathways and examine efficient ways of designing their products.

The EU has launched Ecodesign for Sustainable Products Regulation (ESPR) which aims to “aims to significantly improve the sustainability of products placed on the EU market by improving their circularity, energy performance, recyclability and durability.” Similar legislation is on the books in both the UK and EU for the eco-design of energy-consuming products, mandatory standards for repairability and recyclability.

There is an enormous opportunity for electronics producers to proactively lead on the circular economy. This includes design for continuous re-use, also known as ‘circular design’, making products so that they can be easily broken down in future. By working with e-waste recyclers at a design stage, manufacturers can ensure that their products can be easily recycled when they reach their end-of-life.

New technologies for efficient recycling

The current cost of global e-waste treatment is US$10 billion per year according to the UN, with the largest share paid by producers in countries with EPR regulations. This cost also reflects the fact that only 20% of e-waste is being properly recycled in the first place. An estimated US$78 billion in externalized costs is pushed onto to the public and to nature from the environment from improper recycling.

But where recycling is often viewed as a cost, it can be viewed as an opportunity. It is an area where huge amounts of innovation are taking place, and manufacturers could stand to gain by investing in these new recycling technologies. Embracing the ability to reclaim and reuse raw materials makes recycling a benefit rather than a burden.

The UN e-waste monitor states that patent applications for e-waste management technologies rose from 148 per million in 2010 to 787 per million in 2022, a five-fold increase. Most of these applications related to innovations in cable recycling, where materials like copper are now being widely recycled.

In contrast, there are few signs of an increase in the number of patents filed for technologies related to critical raw materials recovery. An exception to this is Reformation Metals’ own gold reclamation process, which was developed and patented by Canadian clean-tech company Excir with investment from The Royal Mint.

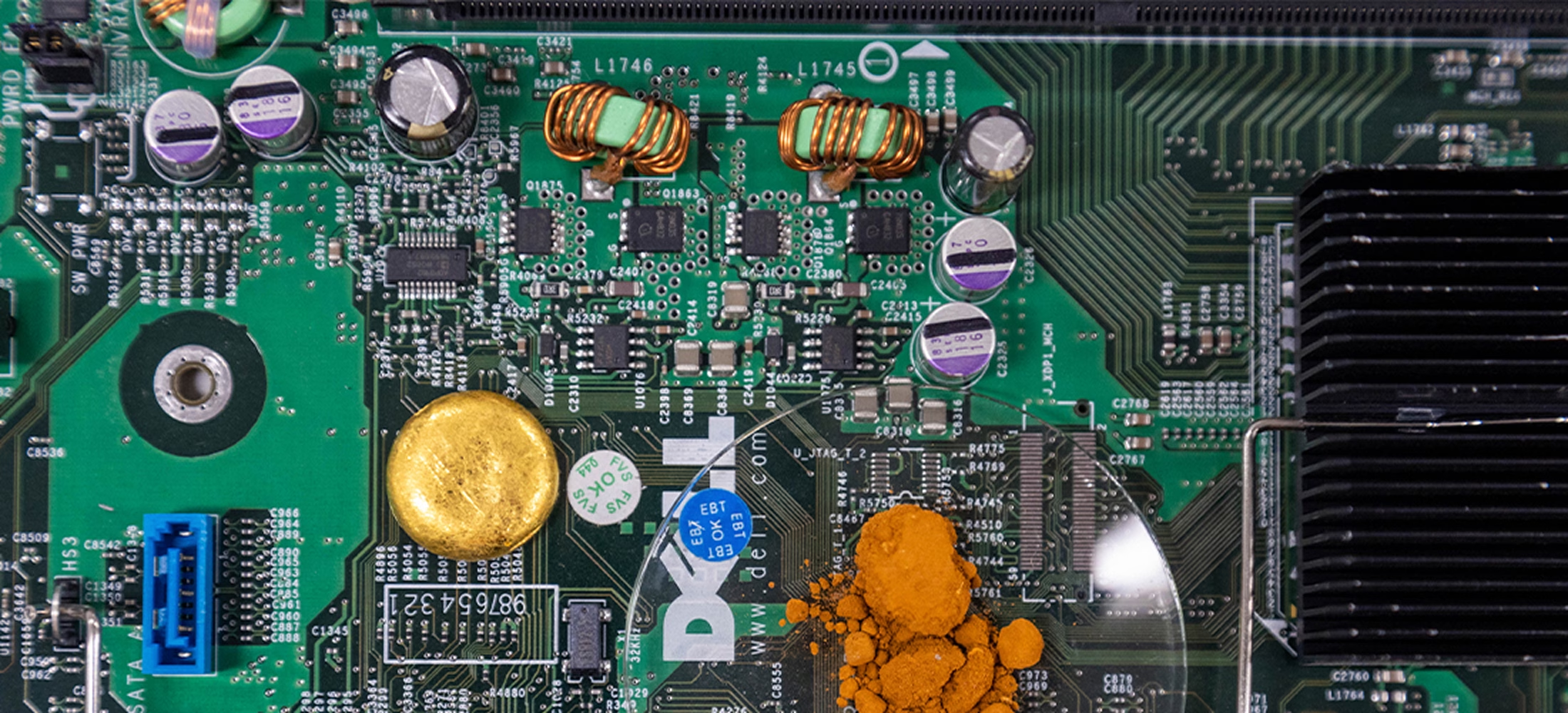

This process uses precise mechanical separation with patented clean-tech chemistry to achieve full material recovery from PCBs with a significantly lower carbon footprint of newly mined gold.

Potential for AI?

One area of increased innovation is AI. Many companies are investing in AI to streamline workflows, increase productivity and speed up production, which can also be applied to e-waste recycling. Although it must be mentioned that AI itself is a huge source of e-waste, and has been found to be environmentally detrimental particularly in areas like water and energy consumption.

The issue with AI, particularly robotics, in e-waste recycling is that the e-waste itself is constantly changing, with new treatments required for new products. This is why the EU has funded a new research project called ReconCycle to develop robots which can reconfigure themselves for new tasks. This project is operating in conjunction with Electrocycling GmbH, one of the largest e-waste recycling facilities in Europe, processing up to 80,000 tonnes of e-waste per year.

Projects like ReconCycle could massively increase our ability to handle e-waste. Large manufacturers already bring expertise in fields like robotics, and by partnering with such initiatives could revolutionise e-waste recycling, increase scale and efficiency, and lower costs.

Reclaimed materials and circular production

The UN’s global e-waste study, conducted in in 2022, estimated that e-waste contains 31 million tonnes of metals, of which 19 million tonnes were returned to circulation. 12 million tonnes were therefore lost, either in the recycling process, through non-compliant management or dumpsites.

The value of all of these metals is estimated at US$91 billion, roughly the same as the annual GDP of Croatia, and avoids the extraction of 90 million tonnes of ore and the significant environmental cost that entails. At current recycling rates, only US$28 billion is being returned to the circular economy.

Precious metals are present in much lower quantities, but up to 300 tonnes could be retrievable. Of the global demand for rare earth minerals, driven by manufacturers, only around 1% is being met by recycled materials. But given the environmental and labour costs of retrieving rare earth minerals, recycled minerals could be a positive step forward for a circular production process.

The Royal Mint: A partner for sustainability

In our millennium of history, The Royal Mint has been trusted by kings, queens and governments, so we can offer a valuable partnership to any OEM embracing sustainability, particularly with the new recycling capabilities offered by our Reformation Metals division.

Building relationships with trusted recycling partners can be a key component of a circular production strategy. Reformation Metals partners with OEMs to develop sustainable recycling pathways to change the journey of end-of-life electronics. By developing these partnerships, manufacturers can maximise the retrievability of precious metals for their own supply chain by fostering a circular economy.